cayman islands tax residency certificate

If any of the information below regarding your tax residence or AEOI classification changes in the future please ensure you advise us of these changes promptly. For foreign nationals not wishing to work in the Cayman Islands but simply wishing to have the right to reside there are alternative options.

Resources For Global Investment And Immigration Uglobal

When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your residence permit.

. Certificate of Permanent Residence for Persons of Independent Means grants the right to live but not work. Residence Certificate Little Cayman or Brac CI500000 investment where at least CI250000 must be in developed real estate in Brac or Little Cayman. Residency Certificate for Persons of Independent Means grants the right to live and work.

Last updated 15 September 2020. In particular one can apply to the Director of WORC for a Residency Certificate which is valid for 25 years and is renewable. Residency Certificate Business Presence The right to reside in the Cayman Islands is available to individuals who either own at least a share in an approved category of business.

There are no corporate income capital gains inheritance. CI20500 issue fee for the main applicant and each dependant must pay CI1000 fee per year. CI75000 annual income or CI400000 deposit in assets the Cayman Islands.

Residency Certificate for Persons of Independent Means. It is responsible for administering all of the Cayman Islands legal frameworks for international cooperation in tax matters and for carrying out the functions of the Tax Information Authority the Cayman Islands competent. Based on the current practice of the Hong Kong Inland Revenue Department IRD a Hong.

Terms referenced in this Form shall have the same meaning as applicable under the relevant Cayman Islands Regulations Guidance Notes or international agreements. An applicant for the grant of Residency Certificate Persons of Independent Means must i provide evidence of a continued source of annual income of no less than US150000 ii at all times maintain a bank account in the Cayman Islands with a balance of not less than US490000 in assets and iii have invested an amount of US1220000 in. The fee to apply for a Certificate of Permanent Residence for Persons of Independent Means is CI500 US60975.

This Certificate is valid for 25 years and is renewable and entitles the holder and any qualifying dependents to reside in the Cayman Islands and work in the business in which they have invested or are employed in a senior management capacity. To reside in Grand Cayman the person must show proof of an annual. This may be relevant or desirable for citizens of European Union EU member states for the purposes of compliance with Reporting of Savings Income Information Law.

Application for the 5-year residencywork certificate. There is no income tax no property tax and no corporate tax. You will pay an additional 1200 per dependent and you will also need to pay any annual work permit fees which vary by industry and employment capacity.

If the application is approved there is a one-time issue fee of CI100000 US12195122. A Residency Certificate Substantial Business Presence is available to individuals who either own at least a 10 share in an approved category of business or will be employed in a. This is a long-term residence category for persons who invest in or who are employed in a senior management capacity within an approved category of business.

Individuals aged over 18 who meet certain financial requirements and make a significant investment in the Cayman Islands may apply for a Certificate for Persons of Independent Means which provides the right to reside in the Cayman Islands for a. The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. Applicants who meet the eligibility criteria and are of good character and health will be issued a Residency.

What are the major benefits of Cayman islands residency. Residency Certificate for Persons of Independent Means. Individual - Taxes on personal income.

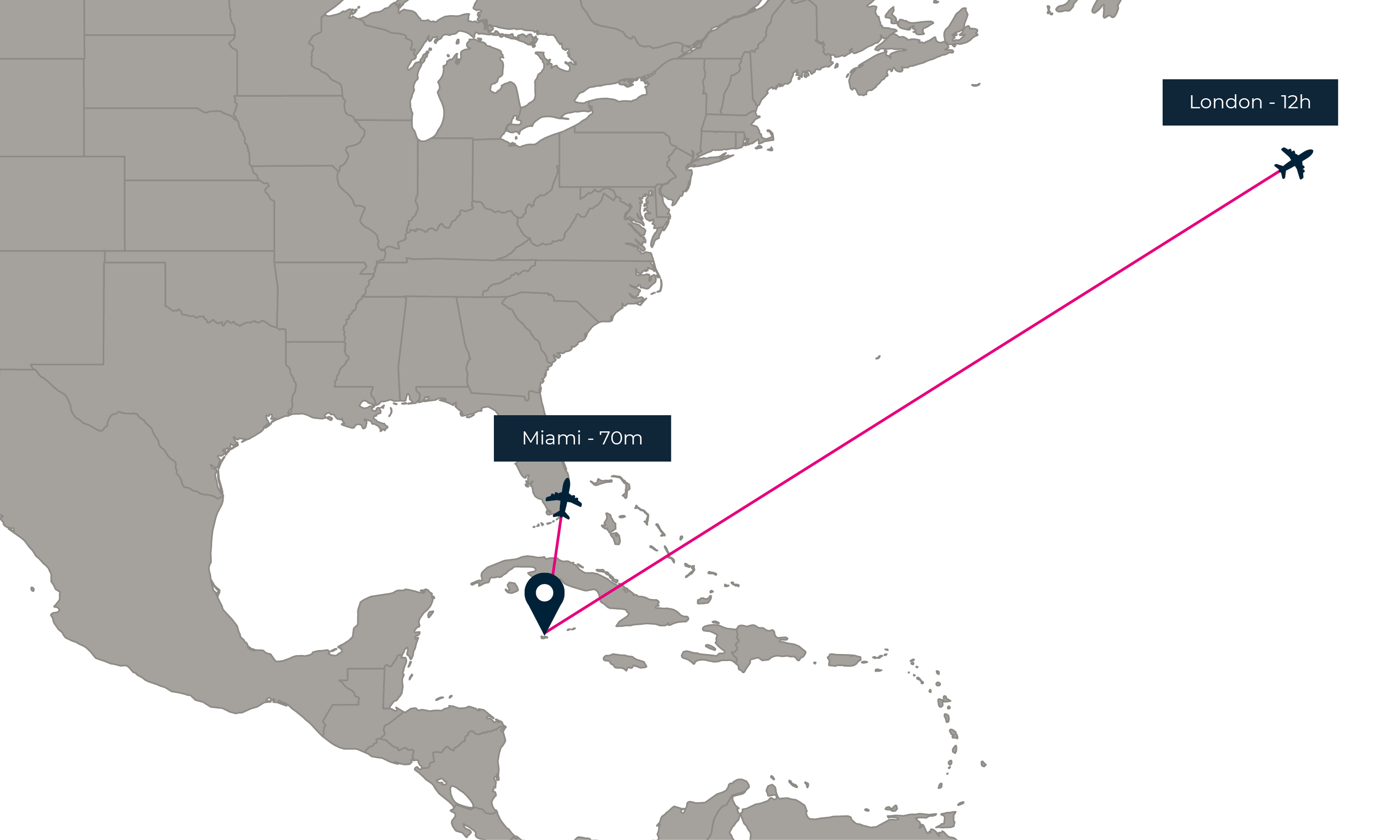

3 The TIA may regard an entity as tax resident outside the Cayman Islands if the entity is subject to tax in another jurisdiction by reason of its domicile residence or any other similar criteria but will require the production of satisfactory evidence to substantiate that claim. The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives. The category is open to persons already resident in the Cayman Islands and persons wishing to become resident.

For each dependent there is a. Entity Self-Certification Instructions for completion We are obliged under the Tax information Authority Law as amended Regulations and Guidance Notes made pursuant to that Law and intergovernmental agreements IGAs entered into by the Cayman Islands in relation to the automatic exchange of information for. Cayman Islands- Tax Efficient Residency Visa.

A minimum 30 days residency is required. We Are Here To Help You. A person who is eighteen years of age or older and who satisfies the requirements set out below may apply to the Chief Immigration Officer for the right to reside in the Cayman Islands as a person of independent means.

This Certificate which is valid for 25 years and renewable thereafter entitles the holder and any qualifying dependants to reside in the Cayman Islands without the right to work. The Department for International Tax Cooperation is a department in the Ministry of Financial Services and Commerce. Corporate - Corporate residence Last reviewed - 08 December 2021 Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate residency is not relevant in the context of Cayman Islands taxation.

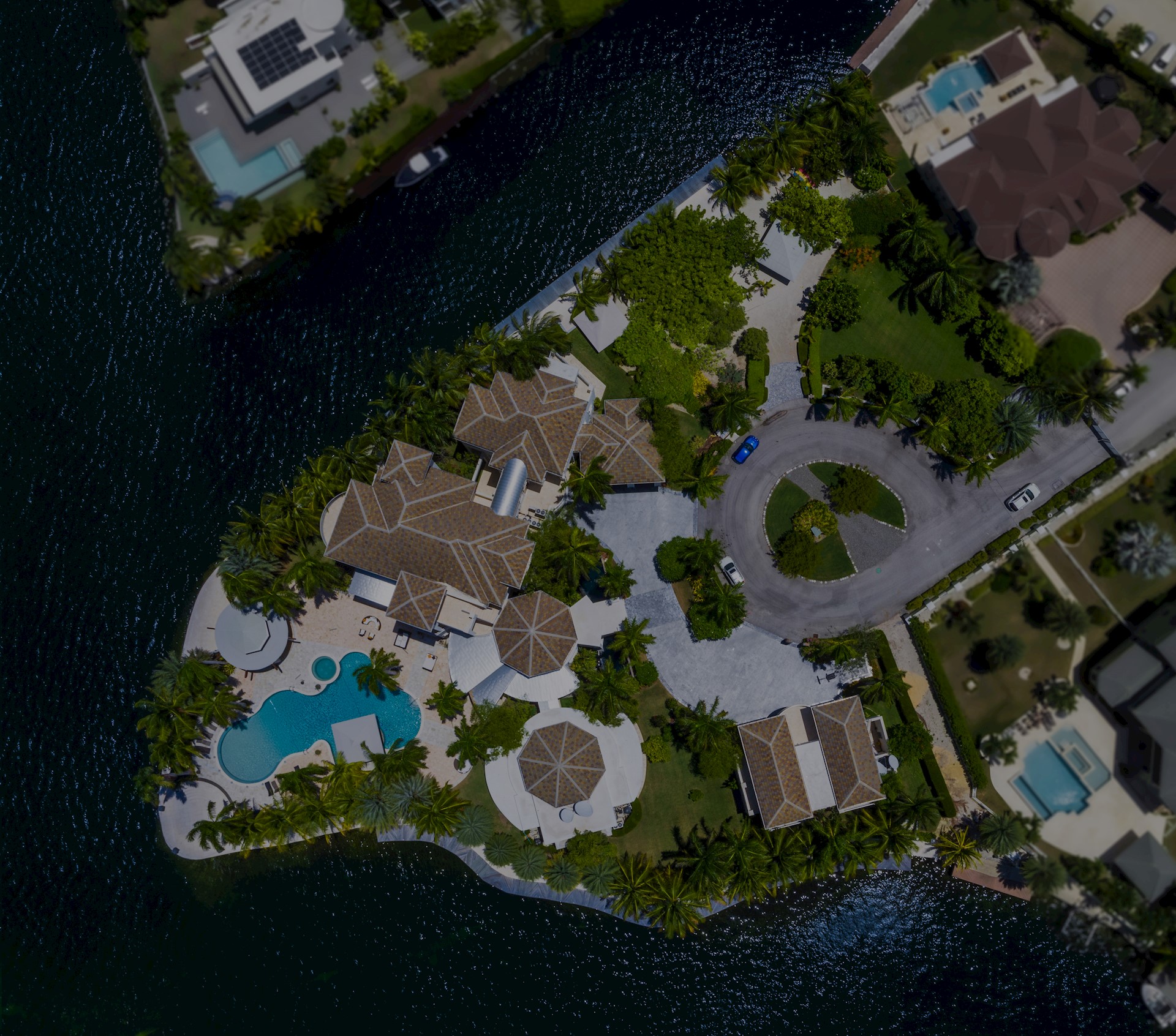

An applicant must invest a minimum of CI1000000 US1219513 of which at least CI500000 US609757 must be in developed. According to the Cayman ES Guidance v204 examples of satisfactory evidence include a tax identification number a tax residence certificate and an assessment or payment of corporate tax liability on all of the Cayman entitys income from a relevant activity in the Islands. A benefactor investing in the economy receives a resident certificate which gives him or her the opportunity to live permanently in the Cayman Islands.

Their role is to assist you in determining which solutions match your requirements to liaise with our partners and prepare and provide you with a. Residency permit issued for 25 years and has. Residency Certificate for Persons of Independent Means.

In addition to Permanent Residency the Cayman Islands offers a Residency Certificate requiring just 12 million investment in real estate. If the application is successful the person. Residency Certificate - Substantial Business Presence allows business owners andor its senior management to live and work in the Cayman Islands for 25 years.

PCS will put you in contact with an adviser in your region.

A Guide To The Benefits Of Cayman Islands Residency Investment Migration Insider

Cayman Joins Neighbours With Global Citizen Programme

Cayman Residency By Investment Guide Provenance Properties

Cayman Residency By Investment Guide Provenance Properties

Cayman Islands Tax Efficient Residency Visa

How To Get Cayman Islands Residency 7th Heaven Properties

Cayman Island Advanced American Tax

How To Get Cayman Islands Residency And Pay Zero Tax

The Cayman Islands Residency By Investment Programme Latitude

Cayman Islands Residence By Investment Programs

A Guide To Cayman Islands Exempted Company Law

The Cayman Islands Residency By Investment Programme Latitude

The Cayman Island Dual Luxury World

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Residency By Investment Guide Provenance Properties

Cayman Islands Residency By Investment Tax Efficient Residency

How To Get Cayman Islands Residency And Pay Zero Tax